Ripple and XRP

Ripple is a global financial network that enables fast, efficient, and cost-effective cross-border payments. XRP is a digital asset that plays a crucial role within the Ripple ecosystem. This deep dive explores the history of Ripple and XRP, delves into the functionalities of XRP, and examines how Ripple’s technology operates.

History of Ripple and XRP

Ripple was founded in 2011 by Jed McCaleb and Chris Larsen. The company initially focused on creating a decentralized payment network called OpenCoin. In 2012, Ripple Labs was established, and XRP was introduced as the native digital asset of the Ripple network. XRP was designed to facilitate fast and efficient transactions on the Ripple network. The initial goal was to build a more efficient alternative to traditional cross-border payment systems.

XRP Functionalities and Use Cases

XRP’s core functionalities and use cases within the Ripple ecosystem are significant.

XRP’s Role in Transactions

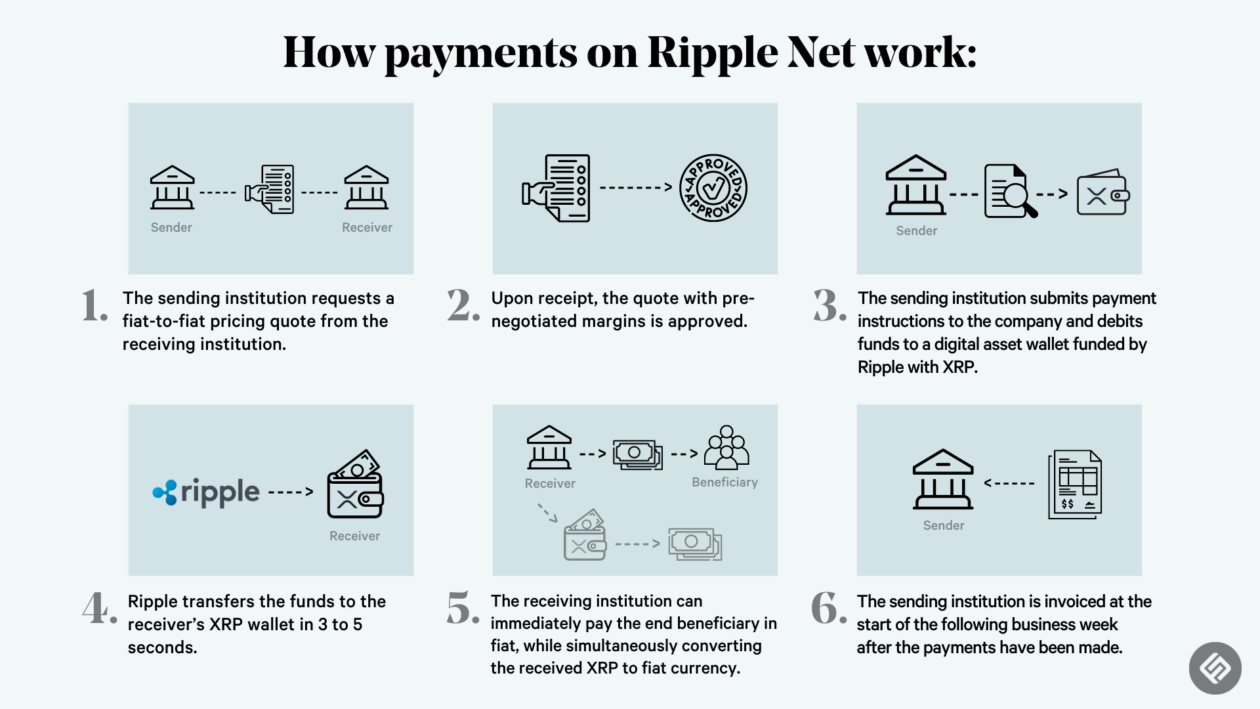

XRP serves as a bridge currency for cross-border payments. It enables faster and more cost-effective transactions between different currencies. For example, a bank in the United States sending funds to a bank in Japan could use XRP to facilitate the transaction, eliminating the need for multiple intermediary banks.

XRP’s Role in Liquidity

XRP is used to provide liquidity to the Ripple network. It enables faster and more efficient settlement of transactions by acting as a readily available asset for exchange. This reduces the need for pre-funding and improves the overall efficiency of the network.

XRP’s Role in Decentralized Exchanges

XRP is used in decentralized exchanges (DEXs) to facilitate the trading of various cryptocurrencies. DEXs allow users to trade cryptocurrencies directly without the need for a central authority.

Ripple’s Technology

Ripple’s technology is based on a distributed ledger, which is a shared database that is replicated across multiple computers. This distributed ledger approach ensures transparency and security.

Consensus Mechanism

Ripple’s consensus mechanism is called the “Ripple Consensus Ledger Agreement” (RCLA). It uses a unique approach to achieve consensus among the network participants. The RCLA ensures that all participants agree on the same version of the ledger, ensuring the integrity of the network.

Transaction Validation

Ripple’s transaction validation process involves several steps:

- Transaction Submission: A transaction is submitted to the network by a participant.

- Transaction Validation: The transaction is validated by the network’s nodes.

- Transaction Confirmation: Once validated, the transaction is added to the ledger.

Ripple’s technology has several advantages over traditional financial systems, including:

- Speed: Transactions on the Ripple network are significantly faster than traditional cross-border payments.

- Cost-Effectiveness: Ripple’s technology reduces the cost of cross-border payments by eliminating intermediaries.

- Security: Ripple’s distributed ledger approach ensures the security and integrity of transactions.

XRP’s Market Dynamics and Adoption: Ripple Xrp

XRP, the native cryptocurrency of the Ripple network, has carved a unique niche in the world of digital assets. Its market dynamics and adoption are influenced by a blend of factors, including its technical features, regulatory landscape, and the growing demand for faster and cheaper cross-border payments.

XRP’s Market Capitalization and Price Volatility

XRP’s market capitalization, which reflects the total value of all XRP in circulation, has fluctuated significantly over the years. The price of XRP, like most cryptocurrencies, is known for its volatility. This volatility is driven by a multitude of factors, including market sentiment, regulatory news, and the overall health of the cryptocurrency market.

Key Factors Driving XRP Adoption

XRP’s adoption is fueled by its unique features, which cater to the specific needs of the financial services industry.

- Speed: XRP transactions are known for their rapid processing times, typically completing within a few seconds. This speed makes it an attractive option for institutions seeking efficient cross-border payments.

- Low Transaction Fees: XRP’s transaction fees are significantly lower compared to other cryptocurrencies and traditional payment methods. This cost-effectiveness makes it appealing to businesses looking to reduce their transaction costs.

- Scalability: The Ripple network is designed to handle a large volume of transactions, making it suitable for institutions with high transaction volumes. This scalability ensures that the network can handle the increasing demand for cross-border payments.

XRP Adoption by Financial Institutions and Businesses

XRP has gained traction among financial institutions and businesses globally, with several notable examples of its adoption:

- MoneyGram: MoneyGram, a leading global money transfer company, partnered with Ripple to use XRP for cross-border payments, streamlining their processes and reducing costs.

- Banco Santander: Santander, a major Spanish bank, has been using Ripple’s technology for international payments, enabling faster and more efficient transactions for its customers.

- American Express: American Express, a global financial services company, has explored the use of XRP for cross-border payments, recognizing its potential to enhance their services.

Ripple’s Legal and Regulatory Landscape

Ripple, the company behind XRP, has found itself entangled in a complex legal battle with the US Securities and Exchange Commission (SEC). The SEC’s allegations, filed in December 2020, have cast a shadow over Ripple’s future and the broader cryptocurrency industry. This legal drama has also sparked discussions about the regulatory landscape surrounding cryptocurrencies globally.

The SEC’s Case Against Ripple

The SEC’s case against Ripple centers around the agency’s claim that XRP is an unregistered security. The SEC argues that Ripple’s sale of XRP to investors constitutes an “investment contract,” which falls under the definition of a security. Ripple, however, maintains that XRP is a digital currency and not a security.

“The SEC’s case against Ripple is a major legal battle that could have far-reaching implications for the cryptocurrency industry.”

The SEC’s lawsuit has raised significant concerns within the cryptocurrency community. The outcome of this case could set a precedent for how other cryptocurrencies are regulated in the US. If the SEC prevails, it could potentially lead to increased regulatory scrutiny and hinder the growth of the cryptocurrency industry.

Potential Implications of the Legal Proceedings, Ripple xrp

The SEC’s lawsuit against Ripple has the potential to significantly impact XRP’s future and its adoption.

Impact on XRP’s Price and Trading

The legal uncertainty surrounding XRP has led to significant volatility in its price. Some exchanges have delisted XRP, while others have restricted trading. This has made it challenging for investors to buy, sell, or hold XRP.

Impact on XRP’s Adoption

The legal proceedings have also created uncertainty for businesses and institutions that are considering using XRP for cross-border payments. Some companies have expressed concerns about the legal risks associated with using XRP.

Regulatory Environment Surrounding Cryptocurrencies Globally

The regulatory landscape surrounding cryptocurrencies is evolving rapidly globally.

Different Regulatory Approaches

Different countries have adopted different regulatory approaches towards cryptocurrencies. Some countries, such as Japan and Singapore, have established clear regulatory frameworks for cryptocurrencies. Other countries, such as the US, are still grappling with how to regulate this emerging industry.

Impact on Ripple’s Operations

The evolving regulatory landscape presents both challenges and opportunities for Ripple. The company is actively engaging with regulators around the world to ensure its operations comply with local laws and regulations.

“Ripple is committed to working with regulators to create a clear and predictable regulatory environment for the cryptocurrency industry.”

The SEC’s case against Ripple is a significant development in the regulatory landscape surrounding cryptocurrencies. The outcome of this case will have a major impact on the future of XRP and the broader cryptocurrency industry.

Ripple XRP, a cryptocurrency designed for cross-border payments, operates on a decentralized ledger that ensures transaction transparency and security. While the blockchain technology behind XRP remains stable, unforeseen circumstances can disrupt global financial systems, such as a ground stop at NYC airports , which could potentially impact the flow of funds and affect XRP’s price fluctuations.

Despite these external factors, Ripple XRP continues to innovate and expand its reach within the global financial landscape.

Ripple XRP, a cryptocurrency designed for cross-border payments, has experienced significant volatility in recent years. Its value fluctuates based on a variety of factors, including market sentiment and regulatory developments. Similar to the trajectory of a football player like alex highsmith , Ripple XRP’s future is dependent on its ability to adapt and overcome challenges, ultimately demonstrating its value proposition in the evolving landscape of digital finance.